One of the most neglected skills in college is the ability to build relationships. While you're studying about microorganisms, the antient Greeks, and the Revolutionary War, sometimes the ability to connect on a meaningful level with others gets forgotten.

Here are a few tips on what is called ‘networking' in business, an important skill to master, regardless of your chosen field of study.

BEFORE

Before you start networking, it is critical to have thought hard about your personal brand and what you most intend to communicate to others. McNally & Speak (2003) write:

“Your [personal] brand takes shape as a result of your ability to make what you do distinctive, relevant, and consistent.”

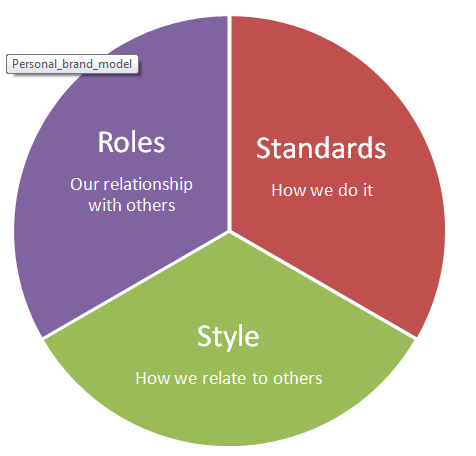

They have a great way of helping you think about what you want to project by developing a personal brand model.

Roles

You begin by identifying the different roles that you play for others in your life.

Standards

This part of the exercise is where you consider how you deliver your roles. These are like your standards of service. What level of performance can others expect from you? Keep in mind that one of the best ways to build a brand is to be distinct – so think about how you are unique in what you deliver to others.

Style

Last, consider how you interact with others. Since a brand ultimately comes down to a relationship a company (or a person) has with a customer (or a person with whom they interact), the way we will relate to others becomes an important aspect of our personal brand.

I suggest that before you attend that networking event, job interview, or your friend's college graduation party, that you reflect on these three elements of your personal brand. You can consider buying Be Your Own Brand: A Breakthrough Formula for Standing Out from the Crowd to go through their exercises and to solidify your approach, or just get out a piece of paper and begin by writing down your roles, standards and style.

While working on my doctorate, one of our professors, Vance Caesar, had us go through this exercise. Below is what I came up with as I considered my on roles, standards and style.

Final preparations

The only other thing you need to do to prepare is to be sure you have a professional way for people to remember you and to keep in touch. If you are working, of course all you need to do is to be sure to tuck a bunch of business cards in your wallet/purse. If you are focused entirely on school or your job is not one where business cards are produced, have some business cards printed that list your contact information. One of the least inexpensive ways to do this is to use a business card template and to print them yourself, using pre-perforated paper products from an office supply store. I also recommend Vista Print, as they frequently have great deals on professionally printed business cards and you can use their templates, if you prefer them over the ones that come with your Word Processing program. The two most important things to remember in this process are:

- Keep your business card design simple and professional (less is more; no graphics, unless they are simple shapes that add to the professional look-and-feel)

- Make sure your email address is professional and contains your first and last name (e.g. john.towers@gmail.com). Gmail still ranks as the best free email application, so consider getting an account, if you don't already have one.

DURING

While you're at the event, capitalize on the opportunity to connect. Arrive well before the ‘main event,' if you are there to see a speaker or to attend a meeting. When you meet someone new:

- State your name clearly and slowly – it can be tough for people to remember names. You can help by saying your name clearly and slowly and by pausing between your first and last names, so the listener knows where your first name ends and your last name begins. Practice this a few times out loud right now. It may feel silly (especially if you've decided to read this blog while in public), but the listener will never notice you are doing this and will have a greater likelihood of remembering your name.

- Give a firm handshake and maintain eye contact – you know what it is like to have a wimpy handshake. Don't give that same feeling to others. Ask three separate people you trust to shake your hand and give you feedback on what you're communicating in that simple gesture.

- Ask at least three questions to your new contact – the appropriate question to ask can vary considerably, depending on where you are. If you're at a party, a natural conversation starter would be ‘how did you come to know [our host]?” If you are at a professional association, you could ask the person about how they have been involved in the organization and if they have any recommendations for new members. Between the questions, you will of course want to be able to have something to contribute to the conversation, so your lifelong quest for learning will payoff in this sense, too. Ferrazzi (2005) writes in Never Eat Alone: And Other Secrets to Success, One Relationship at a Time

:

“Just remember not to monopolize the conversation or go into long-winded stories. Share your passion, but don't preach it.”

Consider signing up for Ferrazi's tip of the week to keep you current on building relationships for professional success and personal happiness. You will find these additional student-specific tips from Ferrazi useful as you navigate building relationships throughout school.

AFTER

Ferrazi (2005) reminds us that:

“If 80% of success is, as Woody Allen once said, showing up, then 80% of building and maintaining relationships is just staying in touch.”

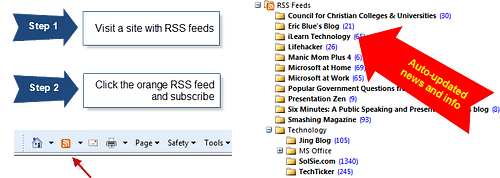

With all the juggling of priorities that we're expected to do these days, we can tend to prioritize higher those pieces of data that hit us most recently. If you want to form a relationship with someone, you will need to follow up after a first meeting in more than one of the following ways:

- Send an email with a resource they might benefit from, based on your conversation

- Call to say it was nice meeting them and to thank them for the advice they gave

- Follow up with a hand-written thank you note, particularly if you met one-on-one

- Find out when their birthday is (not at your first encounter, but as the relationship progresses) and call them to wish them a happy birthday on their special day

- Forward a timely news story, related to their career or industry

It comes down to being authentic. Helping others achieve their dreams as you pursue yours… If your personal mission involves more than just meeting your own needs, you will no doubt be naturally gifted networker as you seek to change the world.